It’s Black Friday, and people are going on a spending frenzy that can only be compared to Christmas. Not only that but Cyber Monday is also coming up, and that means that plastic cards will be pulled out once more to cash in on all the great deals available. During this festive spending season, card fraud is at its highest and people do best thinking twice before they use their credit cards. Numbers from all over the world is indicating that it will be a record-breaking year for fraudulent activities, and it is of course a worrying development.

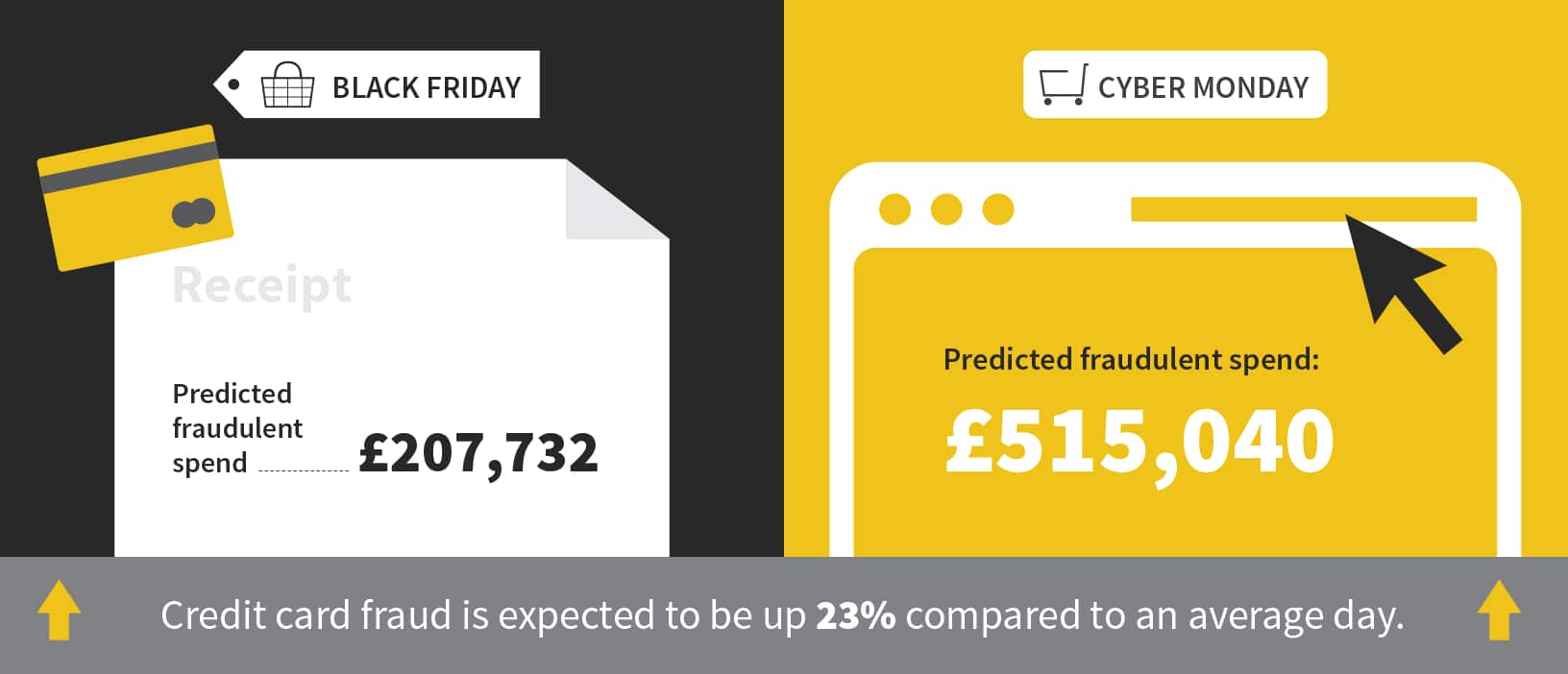

UK is estimated to see record-breaking spending figures on Black Friday and Cyber Monday. Based on past figures from the UK Cards Association and Barclays, Gocompare.com predicts that around £515,040 will be spent fraudulently on cards on Cyber Monday. Black Friday will add around £207,732 more in fraudulent spending, but this could increase if sales soar higher than expected. This is definitely indicating that card fraud is on the rise and should be taken seriously.

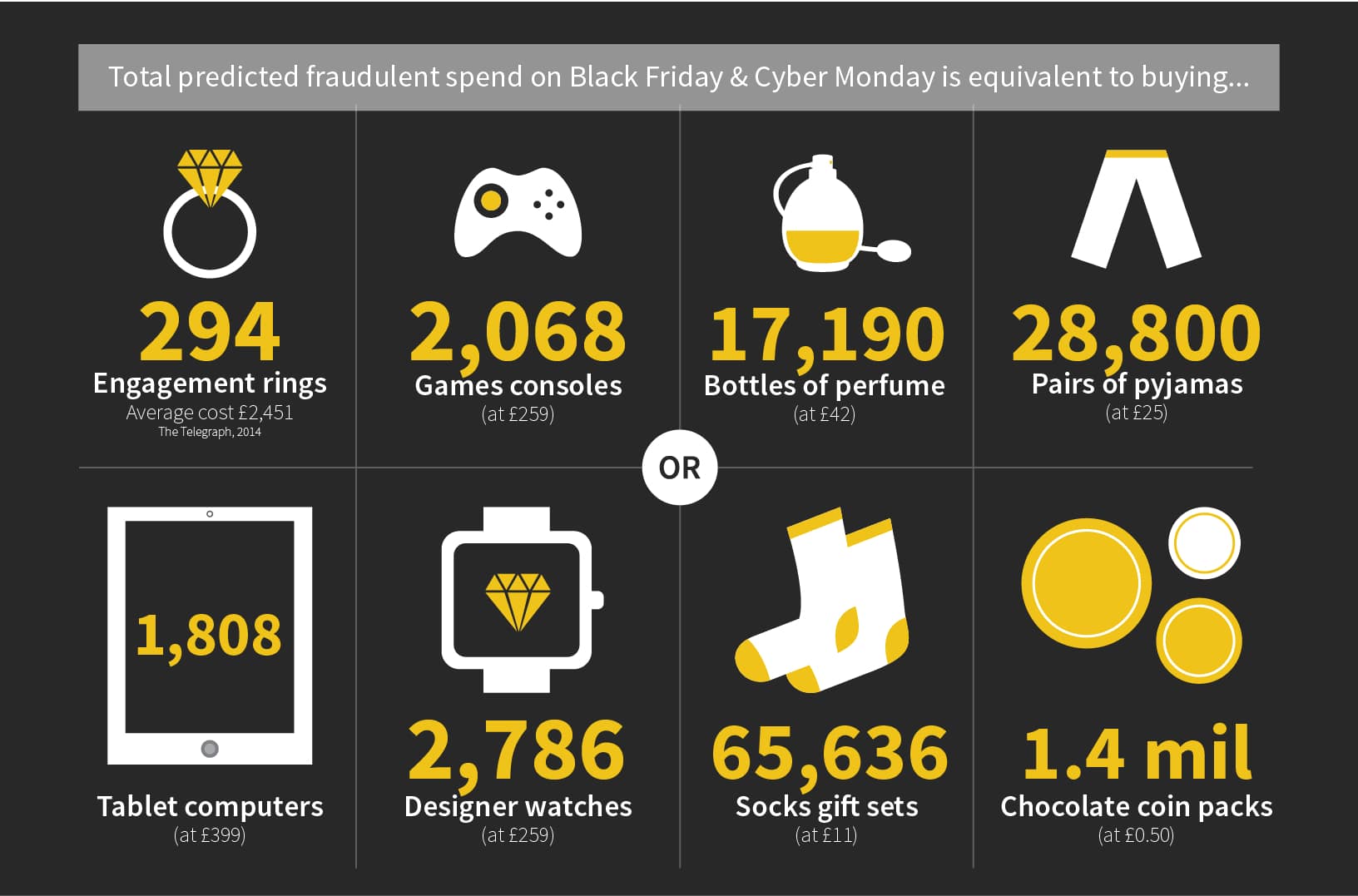

When looking closer at the numbers presented, the expected money to be spent fraudulently in the UK alone during Black Friday and Cyber Monday could buy you 1,808 tablets or even 2,068 video game consoles. As you can see, we’re not talking about pocket change at this point. Card fraud is a real problem and while increasing, it’s time to become a little bit more aware.

Claire Peate, spokesperson at Gocompare.com, commented: “With increased card spending comes a greater risk of fraud as criminals seek to treat themselves to an early Christmas present at the expense of consumers and retailers.

Online shopping is generally safe and makes Christmas shopping so much more convenient, but it’s just important that people keep their passwords safe and card details secure to prevent fraud.

This isn’t just a message for consumers; retailers also need to be aware of enhanced security measures, making sure their sites are as fraud-proof as possible and that customer details are safe and secure.”

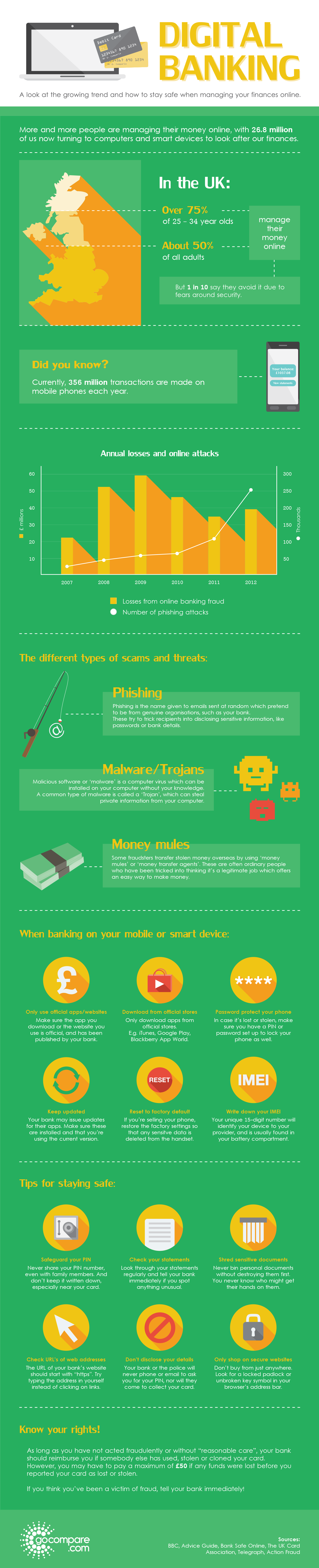

As 50% of spending now occurring on credit cards, it’s important to remember that we keep our plastics safe and in good order. Taking a second look at your statements could help you spot any anomalies early and alert your bank of the card fraud you’ve been subject to. To help consumers keep their credit cards safe, Gocompare.com has put together some top tips for ensuring safety over the festive season.

- Pay for large items online using a credit card instead of a debit card. Section 75 of the Consumer Credit Act ensures your credit card provider is jointly liable to reimburse you for items over the value of £100 if you’re subject to fraud, or if the item is faulty or the company goes bust.

- Before entering details on a website, look for the padlock icon and ‘https’ in the address bar – it suggests you’re in a secure area of the site.

- Get registered with ‘Verified by Visa’ or ‘MasterCard SecureCode’, they will provide you with extra protection when purchasing online.

- Always log out of accounts as many save your details meaning that the next person to use your computer could have access to your information.

By implementing these simple procedures when shopping, you can protect yourself from being a victim of card fraud to a minimum and enjoy your festive spending the right way. Don’t let the bad guys cut into your happiness, instead enjoy all the great offers made available during this festive season. Happy shopping!

Black Friday & Cyber Monday Card Fraud Visualized

Click Infographic To Enlarge

COMMENTS