A decade ago, finding investors and getting a business funded was a whole lot more difficult than it is today. These days, with crowdsourcing sites combined with the power of social media, we see businesses get funded and people’s dreams come true in a matter of days, not years. If your startup is passed the crowdsourcing and angel investor stage, and if you’re ready to gain the attention of the big dogs, how do you go about it? What makes a startup attractive to venture capitalists?

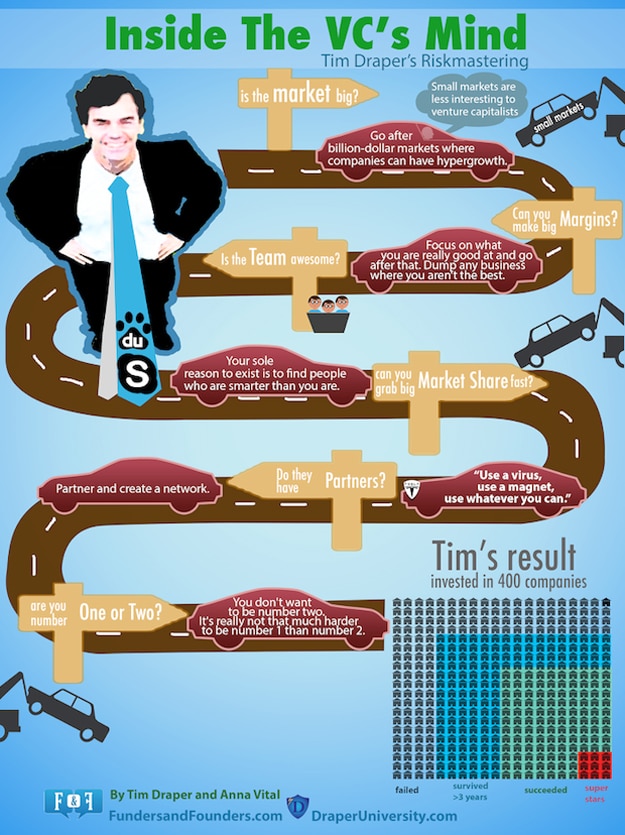

Tim Draper, the VC behind such companies as Tesla, Skype, Path, Box and Baidu (China’s Google), has invested in 400 startups over the years. Anna Vital from FundersandFounders.com recently interviewed him to find out what he looks for in a company. Together, they created this chart which shows the things that make venture capitalists interested in a company.

Very few startups get to the stage of funding where venture capitalists are involved, and even if they do get VC funding, that does not guarantee success. If you look at the chart below, you can see that out of the 400 companies that Tim Draper has invested in, only 120 have been successful, and out of that number, only 9 have been superstars. It’s a high risk business, but when it pays off, it pays off big.

According to this, venture capitalists look for startups that have a high profit margin, and those that can grab a big market share fast. This chart really pushes the adage ‘focus on your strengths’ to the limit. Also, there is mention of partnerships and networks. Tim Draper goes into this aspect even more in a recent Forbes interview called What’s Your Innovation Ecosystem?. As an entrepreneur, I find all of this very inspiring. I hope you agree. Enjoy!

Ways To Make Your Business Attractive To Venture Capitalists

Via: [FundersandFounders]

COMMENTS